What Is The Difference Between Homeowners Insurance and Hurricane Insurance and Flood Insurance?

Yes… Flooding, Storm Damage Or Hurricane Damage Could Happen To You (if you are reading this, you already know this): You see it on the news… A homeowner finds out that their homeowners’ insurance doesn’t cover property damage caused by hurricanes and floods.

What Is The Difference Between Homeowners Insurance and Hurricane Insurance and Flood Insurance? Flood insurance, generally covers water coming into your home from off of your property. Hurricane insurance is for wind damage, not flooding, from a storm over 74 mph, ie a hurricane. Once winds drop below 74 mph, i.e., a tropical storm or less, any wind damage would most likely be covered under your homeowners’ insurance. Again, your property insurance, generally, covers wind and water damage from in other situations.

Hawai’i And Flood Insurance: In case of flooding, like if the stream overflowed or in Hawaii, we have a lot of mountains and there’s heavy rain and the water flows down in the hill and goes into your home, that’s flood insurance. It’s not covered under homeowners or hurricane typically. Many people think that because they’re not in a flood zone and their vendor doesn’t require flood insurance that they don’t need flood insurance, but as the flood insurance program says, most flooding often occurs outside of a flood zone, so people should consider that as additional coverage and purchase it.

There Is A Waiting Period Before Insurance Takes Effect: Imagine you are watching local news and the weather report says a major hurricane has just changed course and is coming for your home. So you get on the phone with your insurance agent and order hurricane insurance. Most insurance policies impose an up to a 30-day waiting between the time you buy and the time coverage takes effect.

From KHON2

Do You Need Flood Insurance? If you live in a potentially affected area — which could include everything from a home on the coast near a fragile levee that sees frequent floods to one downhill from a stream that hasn’t flooded in years — you probably should buy a separate flood insurance policy to cover your home and its contents.

25% Of Floods Occur Outside Flood Zones: According to FEMA, almost 25% of all flood insurance claims come from areas with low-to-moderate flood risk. The good news is that you’ll qualify for a preferred-risk policy. The premiums for this type of policy start at about $150 per year (for both property and contents).

Is Your Hawai’i Property Located In A Flood Hazard? You can enter your exact address, anywhere in Hawaii, and the Hawai‘i Flood Hazard Assessment Tool will indicate where flood hazards exist near you. Use this Hawaii Flood Insurance Map tool to see if your residence or business is a flooding prone area.

Click For Searchable Flood Hazard Map (Kona & All Of Hawaii)

Click For Searchable Flood Hazard Map (Kona & All Of Hawaii)

But even the best home insurance won’t pay for every kind of hurricane damage. If you live in hurricane territory, understanding what your homeowners’ policy will and won’t cover is key to finding the right hurricane insurance.

The One, Two Punch Of Storms: Hurricanes bring two main problems – water and wind. Depending on where you live, you may need to buy these separate policies in order to cover hurricane damage:

Flood insurance: No homeowners insurance policy will cover floods, including water from a storm surge. To get coverage, you’ll need flood insurance.

Hurricane/Windstorm insurance: Homeowners insurance policies in some hurricane-prone states won’t pay for windstorm damage. If you live in one of these states and want coverage, buy a separate windstorm insurance policy.

What Is The Cost Of Hurricane Insurance? The cost of a hurricane or windstorm insurance policy depends on the amount of your deductible, where you live, and how much it would cost to rebuild your house.

What Is The Cost Of Flood Insurance? Flood insurance costs also depend on where you live and the deductible you choose. But a $100,000 flood insurance policy costs about $400 per year, according to the NFIP.

Tips For Buying Hurricane Insurance: Whether you’re buying homeowners insurance, flood insurance or windstorm insurance — or all three — make sure you have enough coverage to pay for the full cost of rebuilding your house. Your insurance agent can help you pinpoint the right amount.

Comparing Insurance Deductibles Between Homeowners’ Insurance and Hurricane Insurance: Home insurance deductibles are often a flat dollar amount, such as $1,000, while hurricane/windstorm deductibles are typically a percentage of your home’s insured value. They usually range from 1% to 5%, though they can be higher in high-risk coastal areas. For example, if your home is insured for $500,000 and you have a 5% wind deductible, $25,000 will be deducted from your payment if you file a claim.

Flood insurance in the U.S. is carried by the federal National Flood Insurance Program but can be purchased through agents or companies.

While flooding damage is common in a hurricane, most flood damage is not covered by hurricane insurance. When water seeps or rushes into a home or structure during a storm, that is when flood insurance kicks in. Homes in flood zones are required to carry flood insurance by their mortgage lenders.

You may not be in a flood zone but could potentially face flooding. For example: if you live at the bottom of a mountainous slope, large amounts of rain could flow into your home from an accumulation above.

The National Flood Insurance Program Hawaii: The National Flood Insurance Program (NFIP) is a Federal program, which was established to allow property owners in participating communities to purchase insurance protection against losses from flooding.

Participation in the NFIP is based on an agreement between local communities and the Federal Government that states if a community will adopt and enforce a floodplain management ordinance to reduce future flood risks to new construction and substantial improvements in Special Flood Hazard Areas, the Federal Government will make flood insurance available within the community at a low cost.

Why Buy Flood Insurance? No home is completely safe from potential flooding. Flood insurance can be the difference between recovering and being financially devastated. Just one inch of water in a home can cost more than $25,000 in damage.

Where To Buy Flood Insurance: You can buy flood insurance from your broker or agent through the National Flood Insurance Program (NFIP), which is managed by the Federal Emergency Management Agency (FEMA). Flood insurance is available to any homeowner who lives in one of the many NFIP-participating communities (which have agreed to pass and enforce certain stormwater and floodplain management laws).

The Cost of Flooding: Flooding can be an emotionally and financially devastating event. Without flood insurance, most residents have to pay out of pocket or take out loans to repair and replace damaged items. With flood insurance, you’re able to recover faster and more fully. Use the tool below to see how much flood damage—even from just a few inches of water—could cost you.

Buy Flood Insurance Coverage for Property and Contents: A flood insurance policy through the NFIP can provide maximum coverage of $250,000 for property and $100,000 for contents. (Property and contents coverage must be purchased separately, even though they may form part of the same policy.) If you want additional coverage, you can purchase excess flood insurance from private insurers. The average flood insurance policy costs less around $700 per year, according to the NFIP.

If you buy a home in a designated high-risk flood zone and get a mortgage loan from a federally regulated or insured lender, your lender must require that you purchase flood insurance.

Here’s what flood insurance pays out for each type of property covered:

- Contents Insurance. Flood insurance pays actual cash value (not the most generous amount — it means the cost to replace the damaged or lost property based on its actual, depreciated value as used goods).

- Property Insurance. You can opt for replacement cost coverage (the cost to replace the damaged or lost property with a new property, without regard to depreciation) if you’re insuring a single-family home that is your primary residence. Available coverage is at least 80% of the full replacement cost of the building (an amount that’s set in advance for your property) or the maximum available under the NFIP.

Do You Need Flood Insurance? Here are some important facts to keep in mind:

- Flood Insurance Fact: Homeowners and renters insurance does not typically cover flood damage.

- Flood Insurance Fact: More than 20 percent of flood claims come from properties outside high-risk flood zones.

- Flood Insurance Fact: Flood insurance can pay regardless of whether or not there is a Presidential Disaster Declaration.

- Flood Insurance Fact: Disaster assistance comes in two forms: a U.S. Small Business Administration loan, which must be paid back with interest, or a FEMA disaster grant, which is about $5,000 on average per household. By comparison, the average flood insurance claim is nearly $30,000 and does not have to be repaid.

What Flood Insurance Doesn’t Cover: It is as important to know what flood insurance covers as well as what flood insurance doesn’t cover. A good flood insurance policy can be a financial lifeboat following a destructive event such as a hurricane. But flood insurance doesn’t cover everything. Before buying, you should know about the following key restrictions and limitations, which are specific to flood insurance.

- The Flood Water Must Have Come From Outside Your Home: If something breaks or malfunctions inside your home — for instance, pipes freeze and burst or a toilet overflows — and this leads to flooding, your flood insurance policy won’t apply. However, your homeowners’ policy should cover these types of losses. Ask your agent or broker to give you the lowdown.

- Swimming Pools and Landscaping Aren’t Covered: If something goes wrong with a swimming pool on your property and this causes your home to sustain flood damage, your flood insurance policy won’t apply. Also, don’t expect any reimbursement for flood damage to flower beds, vegetable gardens, trees, or other landscaping on your property.

- Small Floods Don’t Count: Small floods may not count to your insurance carrier, but they count to you. To be considered a flood, the water that causes damage must have covered at least two acres or have affected at least one other property. Also, if your home sustains any mold or mildew damage that you could have prevented from occurring, your policy won’t cover such damage.

- Living Expenses or Business Interruption Aren’t Covered: Your flood insurance policy won’t pay you for any living expenses you may incur (such as renting a hotel room until your property is fixed). Also, you won’t recover any financial losses caused by business interruption (if you operated a business out of your home) or any other loss of your home’s use.

- Money and Important Papers Aren’t Covered: Your policy won’t pay for the value of any currency, precious metals, stock certificates, and other valuable papers that get destroyed in a flood. Get a fireproof/flood proof safe and take pictures of everything important to you.

- Improvements and Most Contents in Below-Ground Areas Aren’t Covered: Your flood insurance policy won’t cover any improvements you’ve made to your basement, such as finished walls or floors. Also, almost all personal property (including clothing, computers and electronic equipment, kitchen and office supplies, and furniture) located in basements or other areas of your home below the lowest elevated floor aren’t covered.

Tips For The Insurance Adjustor Visit: Insurers usually send an adjuster to survey your specific home and property damage. Be careful how you interact with him or her. If an independent adjuster, as opposed to an employee, shows up, ask if this individual is authorized to make a claim decision and what company they actually work for. Again, keep meticulous records about your conversations and document your interactions immediately after any meeting or phone call.

Insurers often suggest a preferred contractor make repairs, but you’re are not under any obligation to use them. Be aware that the repair costs may not fully compensate you for your damages. This is particularly true in areas of total devastation where contractors can virtually set their own prices for labor and materials. Be aware of whether building codes have changed since your home was constructed and will, therefore, cost a lot more to repair.

How To File An Insurance Claim: Here is a step-by-step guide on how to file an insurance claim following a hurricane or flood:

Determine Your Flood Loss And Report Your Claim: Once it’s deemed safe by local officials, and you ensured the gas and electricity lines have been turned off, examine your property to determine if there is flood damage. If there is, contact your agent or insurance company to start your flood insurance claim and ask for an Advance Payment to help you begin recovering.

Amazon Products

File ASAP – Don’t Wait: It is important to file the claim with your insurer as soon as possible. The longer you wait, the longer it will take to process your claim. Realize that thousands of insured people will be also filing claims. An additional bonus to an early filing, is the damage is fresh in your mind and you are less likely to omit a covered item.

Take ‘After’ Photos: Be sure to document your flood loss using photos and videos before you start cleaning up your home. You need to be ready to provide an accurate description of damages to your insurer. If you can safely do it, walk around your home and make notes on what was damaged. You should take more pictures than you think you need. Open up drawers, shoot inside closets, take pictures of the contents in your garage and don’t forget landscaping, fences and other external aspects of your home.

Be sure to take photos of your car, truck, motorcycle, RV, boat or any other vehicle you own.

Just because it looks like there is no damage, doesn’t mean that water has entered your car’s interior or engine. And, after the storm, be aware that many ‘flooded cars‘ enter the marketplace.

Insurance Adjustor Needs: Your insurance adjuster will need evidence of the damage to your home and possessions to prepare your repair estimate.

For items like washers and dryers, hot water heaters, kitchen appliances, televisions, and computers, make sure you take a photograph of the make, model, and serial number.

For your building items (e.g., flooring), retain samples such as carpet, wallpaper, and drapes for your adjuster’s inspection.

Do not throw out damaged items: You want an adjuster to see them first. The exception is to immediately throw away flooded content items that pose a health risk, such as perishable food items, clothing, cushions, pillows, etc. after photographing them.

Repair NOW – Don’t Wait: The Insurance Information Institute, is an organization that provides information on insurance issues, suggests you make temporary repairs to your home if they are needed to protect it from further damage. Save the receipts for your repairs and supplies so you can use as documentation for reimbursement.

What If Your Insurance Company Provides Inadequate Funds? Insurance companies are in the business of making money and the more they pay out, the less they make. If your insurer ‘lowballs’ your claim, take your appeal to a higher department at your insurance company. If that fails, file a complaint with the state insurance department. Hiring a lawyer should be your final option. If an attorney can show that your insurer acted ‘in bad faith,’ you could receive additional compensation.

What To Ask Your Insurance Carrier: Once you are able to speak to an insurer, you will need to ask these questions:

- Is the damage you described covered under the terms of your policy?

- How long do you have to file a claim?

- How long will it take to process the claim?

- Do you need estimates for repairs?

Keep Records Of Your Contacts And Claim Numbers: Once you make the claim, be sure to write down the claim number. When you speak to your insurer, record the day and time of the conversation and with whom you spoke. Use your email to send your agent and yourself an email summarizing all your dates, conversations and understandings with your agent and claim. Be sure to document what is said, any timeframes and if any monetary amounts are mentioned.

Is There A Presidential Disaster Declaration In Effect? If there is a Presidential Disaster Declaration, file for FEMA assistance too because you may be eligible for additional funds to help with things like temporary housing. It is beneficial to register for federal disaster assistance from FEMA.

If Your Are Covered By A FEMA Flood Insurance: Please keep in mind that as a FEMA flood insurance policyholder, it is your responsibility to minimize the growth and spread of mold as much as possible. Learn more about the Guidelines for Flood Clean Up for NFIP Policyholders.

Complete A Proof of Loss Form: After you contact them, your insurance company with send you a “proof of loss” form to complete or will send an adjuster – a person trained to assess the damage to property – to your home to get the information on your losses. To speed this process along, start gathering information about your property and the items that were lost or destroyed. A proof of loss form will ask you to describe the items damaged or destroyed, provide the approximate date of purchase and estimate the cost to repair it or replace it. If you happen to be able to produce receipts for items, that would be a help as well.

Keep All Receipts – No Matter How Small: If you are unable to live in your home and must stay elsewhere, keep all receipts for any living expenses – hotel rooms, food, and other costs of evacuation. Most homeowner policies that cover windstorm damage will cover those costs. Use your cell phone to take pictures of everything.

Beware Of Scammers: Be wary of anyone who comes to your door offering to do repairs or claiming to be insurance adjusters. Take pictures of them, their business card and their car/truck – just in case.

What If You Don’t Have Insurance? If you have no insurance, you can register for federal disaster relief at DisasterAssistance.gov. You do that by downloading the FEMA mobile app or by calling 1-800-621-3362.

Disaster assistance can help with temporary housing, home repairs and other disaster-related expenses, including crisis counseling and legal assistance. Click here for more information on FEMA aid.

Additional Hawaii Insurance References

- Hawaii Department of Commerce and Consumer Affairs Insurance

- Visit FloodSmart.gov for more information

- Hawai’i Department of Commerce and Consumer Affairs

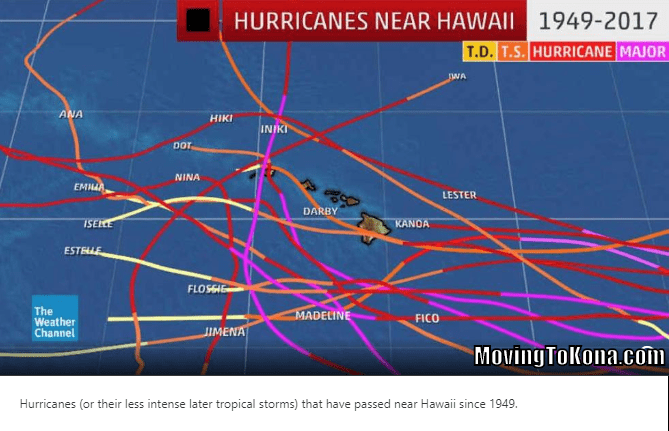

Will The Mountains Protect Kona? I was asking my insurance agent if I needed to buy hurricane insurance, she said, “Most people in Kona do not buy hurricane insurance unless required by their lender. They believe that ‘the mountains will protect them from hurricanes.'” Well, that is mostly true, but not always true – it just depends on how the hurricane approaches the west side of the Big Island. You can see from the graphic below, that while hurricanes approach, initially, from the east, they can take a path that impacts the west side of the islands.

From Smithsonian.com: “Hawaii is a small target in the big ocean, so it just has to be really good timing and the conditions have to be right for us to get a direct hit,” Eric Lau, a meteorologist for the National Weather Service in Honolulu, told the Associated Press in 2014, when two hurricanes were barrelling toward at the islands (they missed).

Mary Beth Griggs at Popular Science also explains that for a hurricane to hit Hawaii it has to overcome some pretty stiff winds. Typically, an atmospheric wind pattern shifts the course of any storms heading towards Hawaii, acting like a force field.

“The major reason that Hawaii doesn’t normally get major hurricanes nearby is that there’s a strong subtropical high-pressure system that sits just to the north, and that acts to steer [storms] straight west,” Brian McNoldy, meteorologist and hurricane researcher at the University of Miami in Florida, tells Griggs.

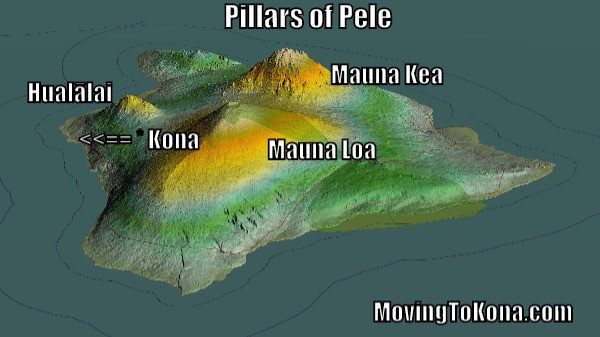

Furthermore, for Kona there is the…

The Kona Rain Shadow: Three Pele-grown mountains protect Kona when weather originates from the east (and sometimes to the south): Mauna Kea at 13,803 feet, Mauna Loa at 13,679 feet and Hualalai at 8,271 feet.

A mere six inches of fast-moving flood water can knock over an adult. And it only takes 12 to 18 inches of flowing water to carry away most vehicles including large SUVs. If you come to an area that is covered with water, you will likely not know the depth of the water or the condition of the ground under the water. This is especially true at night, when your vision is more limited. Play it smart, play it safe. Whether driving or walking, any time you come to a flooded road, follow this simple advice: Turn Around Don’t Drown.

Here are safety tips to protect you during flooding:

- Always plan ahead and know the risks before flooding happens. Monitor NOAA’s All-Hazards Radio, or your favorite news source for vital weather related information before, during and even after a disaster.

- If flooding is expected or is occurring, get to higher ground FAST! Leave typical flood areas such as ditches, ravines, dips or low spots, and canyons.

- Avoid areas already flooded, especially if the water is flowing fast. Do not attempt to cross flowing streams. Turn Around Don’t Drown.

- NEVER drive through flooded roadways. Road beds may be washed out under flood waters. Turn Around Don’t Drown.

- Do not camp or park your vehicle along streams and washes, particularly during threatening conditions.

- Be especially cautious at night when it is harder to recognize flood dangers.

- Never cross any barriers that are put in place by local emergency officials. Not only is this dangerous, but many states and communities levy steep fines for people that ignore barricades or other road closure indications.

- Play it safe, Turn Around Don’t Drown.